Chase Bank Cd Rates

- Chase Bank Cd Rates Today

- Chase Bank Exchange Rate Calculator

- Chase Bank Cd Rates

- Chase Bank Cd Rates 2019

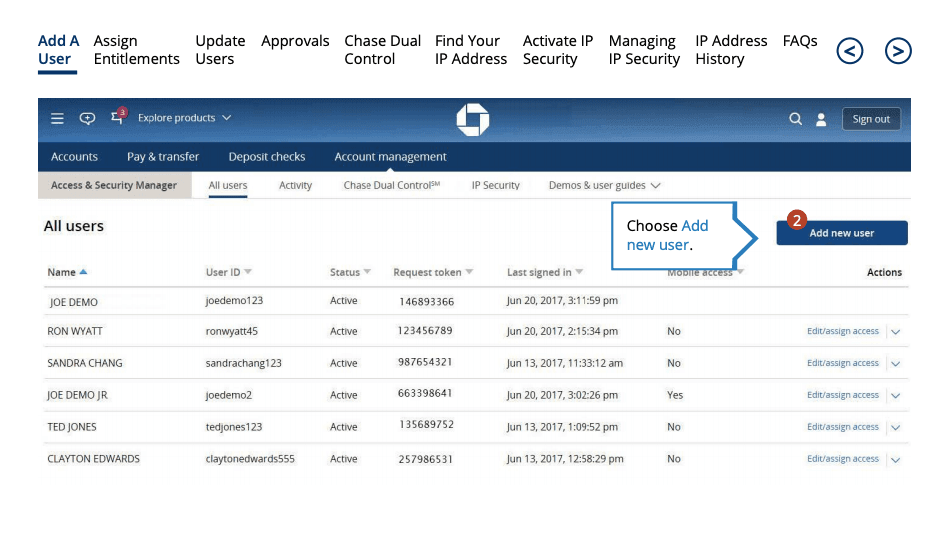

Standard CD rates at Chase Bank are available to anyone and require a minimum deposit of. Chase Bank’s biggest strength when it comes to its certificates of deposit is the wide range.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Build a Certificate of Deposit (CD) ladder

Find a branch- Overview

- How CD Ladders work

- Account benefits

- Find a branch

- FAQs

Make your savings work harder for your business

A CD ladder allows you to open four CDs at the same time, for the same amount, but maturing at staggered intervals.

Here’s an example for a 12-month CD ladder:

You open four CDs at the same time, with 3-, 6-, 9- and 12-month terms.

When each CD matures, its new term automatically changes to 12 months.

The result is four 12-month CDs, with one maturing every three months.

Design your personalized CD laddering strategy today.

More benefits of a CD ladder

Cash is available at planned intervals to help cover expenses.

CDs that reach maturity can be rolled into a new CD that matches the APY and term of the longest CD or you can use the money.

You’ll earn a fixed interest rate and have the security of FDIC insurance.

Go to your local branch to get started

Frequently Asked Questions

What is a CD ladder?

open accordion

open accordionA CD ladder is a group of CDs opened at the same time for the same amount, but with different terms. When each CD matures, its term will change to the longest term of the ladder.

What are the benefits of a CD ladder?

open accordionA CD ladder allows you to earn interest over time and potentially take advantage of rising rates while also providing you with steady access to your money.

What are the term options for a CD ladder?

open accordion

open accordionWe offer two CD ladders: A 4-month CD ladder made up initially of 1-, 2-, 3- and 4-month term CDs, and a 12-month CD ladder made up initially of 3-, 6-, 9- and 12-month term CDs. Each CD in the ladder receives its own unique account number and CD receipt at account opening.

How do I open a CD ladder?

open accordionCD ladders can be opened by a banker at any branch, but cannot be opened online at this time. All 4 CDs in a ladder are opened at the same time, for the same amount, with a minimum of $1,000 in each CD. CD ladders can be opened only for qualifying Chase Private Client or Business Banking clients.

Will each CD in the ladder renew automatically?

open accordionEach CD will automatically renew to the longest term of the ladder (either 4 or 12 months). You'll be reminded of the new term on your CD Maturity Notice, which you'll receive as each CD in the ladder reaches maturity.

Can I add or withdraw money once the CD in a ladder matures?

Chase Bank Cd Rates Today

open accordionChase Bank Exchange Rate Calculator

You may add or withdraw money in a CD during the grace period following each CD’s maturity date.

How do interest rates work for CD ladders?

Chase Bank Cd Rates

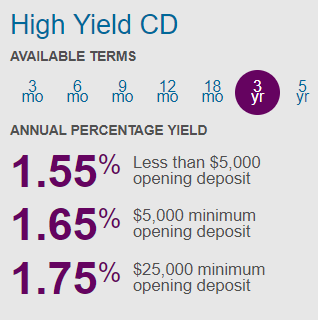

open accordionInterest rates vary based on the account balance at opening or renewal. See the CD ladder section of the Deposit Rate Sheet for the specific interest rate for each CD term in a ladder.

Can I change a standard CD to a CD ladder?

open accordionChase Bank Cd Rates 2019

A standard CD cannot be changed to a CD ladder. However, once your CD matures you can choose to withdraw funds from your standard CD and open a CD ladder as a group of 4 CDs.