Citi Cd Rates

Citi Cd Rates Average ratng: 3,9/5 8053 reviews

Citi CD rates are surprisingly competitive for a brick-and-mortar bank. With their variety of terms, low deposit requirements, and above-average APYs, Citi CDs are a good fit for savings balances. Information on Citibank 3 Month CD Rates: This type of Interest bearing deposit is savings product for Citi retail customers who have available funds to invest in this product that requires a contractual maturity of three months or 90 days.

| Deposit Rates | APY | Vs.Others |

|---|---|---|

| Savings | 0.50% | 0.66% → |

| 1-Year CD | N.A. | 0.71% → |

| 2-Year CD | N.A. | 0.81% → |

| 3-Year CD | N.A. | 0.91% → |

| 4-Year CD | N.A. | 1.04% → |

| 5-Year CD | N.A. | 1.15% → |

2021 Overview

Citi Jumbo Cd Rates

General Online Bank Information

Citi Cd Rates 2019

Money that you deposit is held by Citibank, National Association.Citibank, National Association is an FDIC insured institution founded in 1812.It has approximately $1,648.67 billion in assets.

Money that you deposit is held by Citibank, National Association.Citibank, National Association is an FDIC insured institution founded in 1812.It has approximately $1,648.67 billion in assets.| Deposits FDIC Insured | Yes |

| Insured Bank | Citibank, National Association |

| FDIC Certificate # | 7213 |

| Date Established | 1812 |

| Assets | $1648.67 billion |

| Loans | $616.55 billion |

| Deposits | $1272.89 billion |

| Capital | $155.11 billion |

For a more detailed analysis of Citibank, National Association's financial conditionand a description of what these numbers mean, please visit the Financial Details section.

| Online Savings and Money Market Rates | APY | MIN | MAX | |

|---|---|---|---|---|

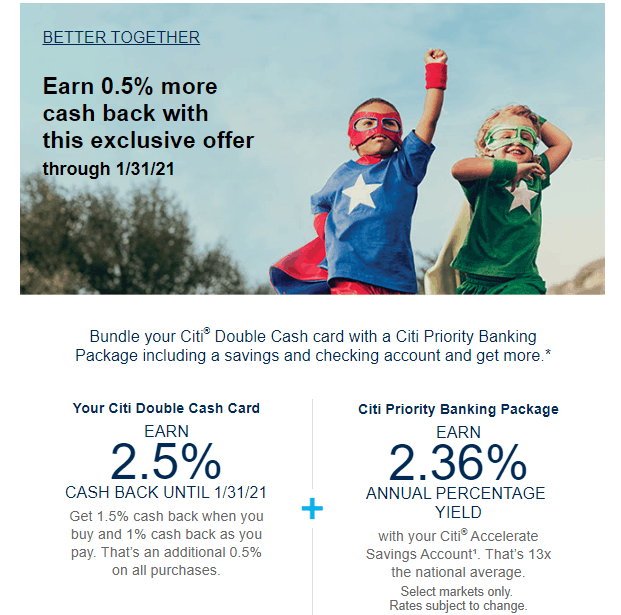

| Accelerate Savings | 0.50% | $0 | - | Learn More |