Deposit Check

- Deposit Checks Online

- Deposit Check Online

- Deposit Checks Online Bank Account

- Deposit Check Online Chase

Choose 'Collect & deposit', then choose 'Deposit Checks' Enter deposit details, then load check(s) into the scanner; Wait for the scanner indicator light, then choose 'Start scanning' After all the checks have scanned, choose 'I’m done scanning' When you’re done scanning and making edits, choose 'Next' Choose 'Send deposit' to complete. There’s the incentive for banks to process a post-dated check when I want to deposit it early. If the check is returned for insufficient funds, I have to pay an expensive insufficient funds fee.

- With the convenience of mobile banking services, it’s pretty easy to deposit check by just taking a couple of photos with your phone. But it's important to remember that you still have to be.

- Ineligible check. If this occurs, you should deposit the check my mail or at a Schwab branch. A check with a stop-payment order may not be deposited. Over client limit. If this occurs, you should deposit the check by mail or at a Schwab branch, or attempt to redeposit the check using your smart phone the following day.

- Mobile deposit allows you to deposit checks from the comfort of your home or office. All you need is the BlueVine mobile app (available in both the Apple App store and the Google Play store ), a properly endorsed check, and a well lit area.

Are you familiar with mobile check deposits?

This means you can deposit checks without going to the bank. And, being able to deposit paper checks, such as a stimulus check, without going to the bank can make things super convenient.

Wondering how to deposit a check this way? If you’ve never used mobile check deposit before, it’s not as difficult as you might think. Take a look at 5 tips that can help you make the most of this feature – saving you valuable time.

1. Check your bank’s mobile check deposit guidelines

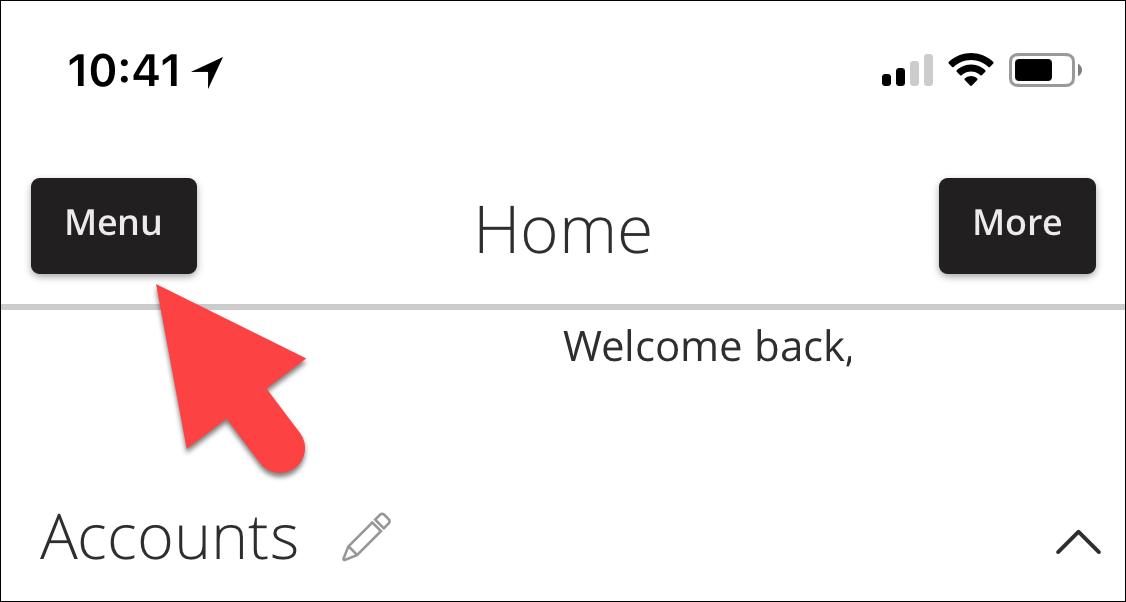

The first thing you need to do is make sure the organization you’re banking with is set up for mobile check deposits. The easiest way to do that is to check your mobile banking app.

When you log into mobile banking, head to the menu and look for the mobile check deposit option. If you see it listed, then your app should allow you to deposit checks online.

Before you try to use mobile check deposit, however, make sure your account is enabled to do so. While the feature may be available in mobile banking, you may still have to register first or sign up.

2. Review mobile check deposit limits

If you know that you’re able to deposit a check through mobile banking, the next step is to determine whether there are any limits on deposits.

For example, some financial institutions impose limits on the number of checks you can deposit per day or per week. There may also be daily, weekly or monthly limits on the total dollar amount you can add to your bank account using mobile check deposit.

So, make sure you can deposit your check without going over those limits. For example, say you’re married with two kids and you received a federal stimulus check for $3,400. If your bank’s mobile check deposit limit is $5,000 per day, you should be able to deposit the entire check online.

You can usually find out about limits if you read your bank account’s terms and conditions. You can also check your online banking website and look for a section on frequently asked questions. Sometimes this is a good place to start.

What if your check is outside mobile check deposit limits? In this case, you’ll need to find a work-around for depositing it into your bank account. With online bank accounts, for instance, you may have to deposit the money to a checking account at a brick-and-mortar bank, and then move it into your other account via an ACH transfer.

3. Get your check ready for deposit

Depositing a check online isn’t exactly the same as depositing it at a branch or ATM. But you still have to sign the back of the check for the deposit to be valid. You also should make sure all the information on the front of the check is correct.

Depending on your bank account, you may also have to write something extra on the back to denote that it’s a mobile deposit. For example, you may have to add “for mobile deposit” or “for remote deposit capture” below your signature.

Also, make sure the check is legible. Your mobile device needs to be able to “read” the check via the camera when you’re ready to deposit it.

Deposit Checks Online

4. Deposit your check via mobile banking

Now you’re ready to deposit a check online!

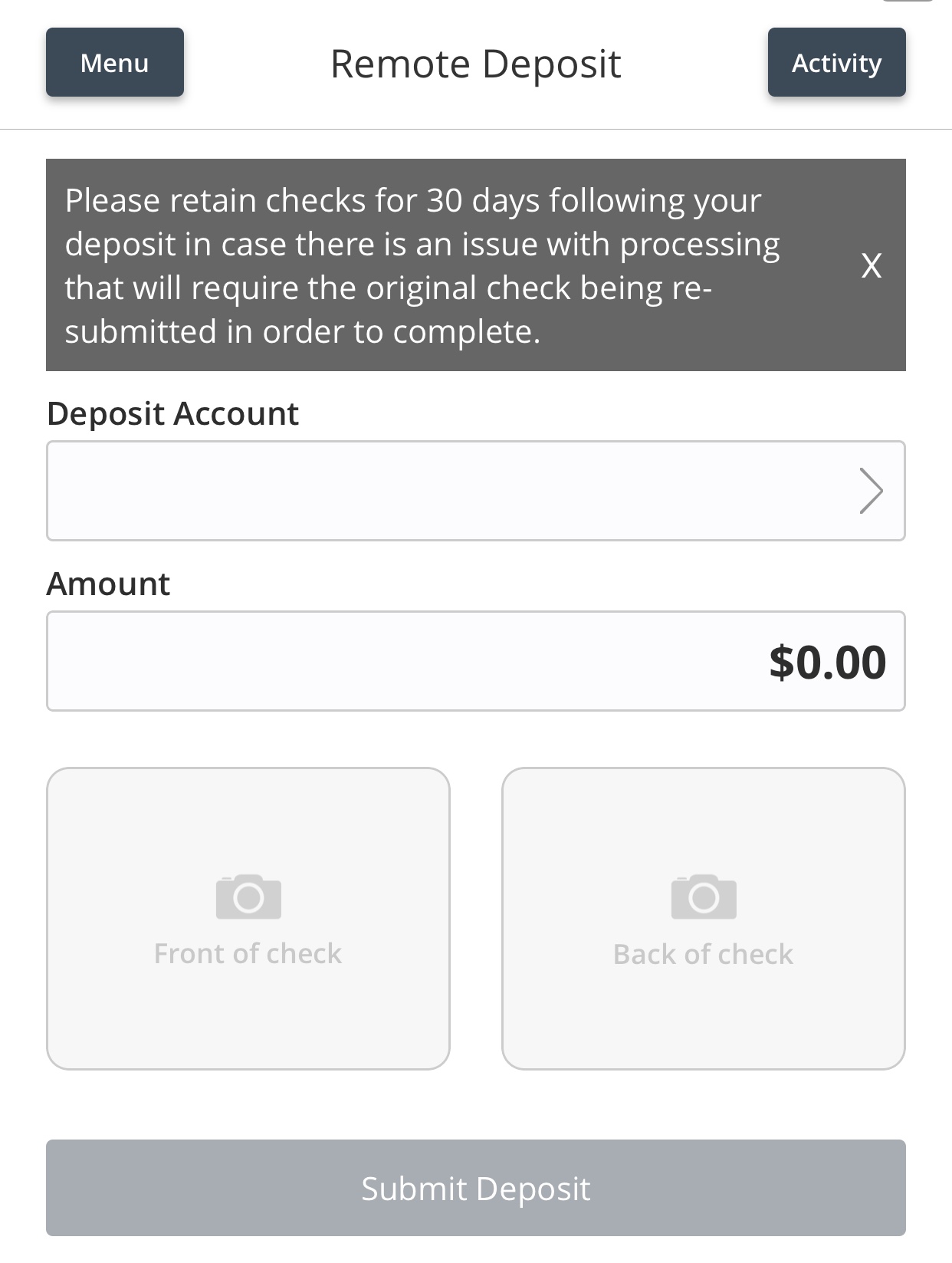

The process can be different depending on your particular bank account. But generally, here’s what you need to do:

- Log into your mobile banking app

- Find the mobile check deposit option in the menu

- Select the account you want to deposit the check into (i.e. checking or savings)

- Enter the check amount

- Snap a photo of the check – front and back. It’s important to make sure you get a clear image of both sides of the check. Otherwise, you may have trouble completing a mobile check deposit. If the images come out fuzzy or blurry, clean off your camera lens. And, make sure you take photos in an area with good lighting so your camera can pick up details on your check.

- Once your device records the images of your check, review the deposit details. Make sure that you’ve signed the check, selected the right account, and entered the correct amount.

5. Wait for the check to clear

If you deposit a stimulus check – or any check – online, you may want to use the money right away. But, you’ll need to wait for the check to clear in your bank account first.

You may now wonder how long it takes for mobile check deposits to clear. Well, this depends on your bank account, the amount of check, and the type of check involved. Again, check your bank account terms and conditions or read through the FAQs. This might offer up some clarity on how long your mobile check deposit will take to be fully credited to your account.

In the meantime, don’t throw the check away. Why? Because there may be a hiccup with your mobile check deposit. If you don’t see the deposit in your account within a week, you may need to call your financial institution to find out what’s happening. You may also need to try making the deposit again.

Once your mobile check deposit clears your bank account, you can then write ‘void’ on the check and file it away.

How to deposit IRS checks with Mobile Check Deposit using Chime

Deposit Check Online

If you are a Chime member and received a government stimulus payment as a paper check, you can deposit it safely and securely at Chime. We take our members’ money seriously, so for these checks, we’re putting extra security measures in place. Here’s how to deposit your IRS checks using our Mobile Check Deposit feature.

1.Make sure the name on the check matches your Chime Spending Account

2. For joint stimulus checks, make sure at least one filer’s name matches the name associated with the Chime Account. Unfortunately, we can’t accept checks that don’t have your name on it

3. Sign the back of your paper check, then write “For deposit to Chime only” under your signature.

For joint stimulus check make sure both of your signatures appear on the back of the check.

4. Open the Chime app, tap Move Money at the bottom of your screen, then tap Mobile Check Deposit, then U.S. Treasury.

Keep in mind: Mobile Check Deposit for stimulus checks is only available to members that actively use their Chime Spending Account and Chime Visa® Debit Card

5. The Chime app will guide you through the check deposit process – it’s easy!

Are you using a mobile banking app for check deposit yet?

Deposit Checks Online Bank Account

Signing up for direct deposit can save you time, but mobile check deposit comes in super handy if you receive a paper check, like a tax refund or stimulus check.

So, if you aren’t taking advantage of mobile check deposit yet, consider signing up. You’ll soon learn just how convenient it is!

Deposit Check Online Chase

How it works:

Process all types of U.S. checks, drawn on any bank or credit union that is a Federal Reserve member, including personal checks, business checks, government checks and warrants, money orders and traveler's checks over the Internet. Using check truncation, the paper checks never leave your office and, in fact, should be destroyed after the successful deposit of funds into your bank.

The use of electronic check conversion - also known as Check 21, Accounts Receivable Check (ARC), Point of Purchase (POP), or Back Office Conversion (BOC) in banking terms - is among the fastest growing types of ACH applications due to its enormous benefits. Using our proprietary Internet-based Back office conversion 'Remote Deposit Capture' software and check scanning reader, you can scan conventional paper checks and transform them into an electronic check deposit. The software also stores the check data and check images in a database for future research and retrieval, re-submission of NSF checks and more.

You accept many checks each month from customers. Currently, you would have to look up each customer account, apply the payment to the account, stamp the check for deposit, create a deposit slip, drive to the bank, stand in a long line and make the deposit. On top of this, your bank will typically charge an 'item deposit fee' for every check you deposit. Too time consuming and too expensive!