Indusind Bank Savings Account Interest Rate

Apr 15, 2020 Karur Vysya Bank savings account interest rate – 2.75% #9. HDFC Savings Account Interest Rate. HDFC Bank is one of the most popular private banks in India. The bank has around 6,000 branches in around 2800 cities across the country. HDFC Bank savings account interest rate – 3.50%. The bank offers two slabs of interest on the savings account. With a shopping limit of Rs. 2,50,000 per day and ATM cash withdrawal limit of Rs. 1,25,000 per day, the IndusInd Platinum plus debit card has accompanied me on various shopping escapades. The bank also offers high interest rate on savings account.

- Indusind Bank Nre Savings Account Interest Rates

- Indusind Bank Savings Account Interest Rate Comparison

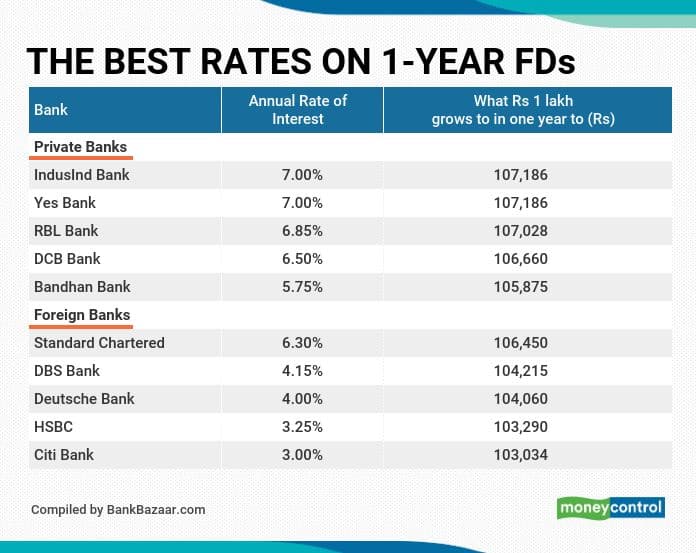

- Indusind Bank Fd Interest Rate

Domestic /NRO/ NRE/Senior Citizen Deposit Rates (all in %)

Please clear browser history/cookies to access the latest effective interest rates.

| w.e.f. December 30th, 2020 | < 2 Cr* (Domestic /NRO/NRE deposits)NRE deposit rates applicable only forTenure 1 year 1 day onwards | < 2 Cr* (Senior Citizen)Not applicable for NRO/NRE deposits | ||

| Tenure | Rates p.a.(%) | Annualised Yield* | Rates p.a.(%) | Annualised Yield* |

| 7 days to 14 days | 3.00 | 3.00 | 3.50 | 3.50 |

| 15 days to 30 days | 3.00 | 3.00 | 3.50 | 3.50 |

| 31 days to 45 days | 3.40 | 3.40 | 3.90 | 3.90 |

| 46 days to 60 days | 3.75 | 3.75 | 4.25 | 4.25 |

| 61 days to 90 days | 4.00 | 4.00 | 4.50 | 4.50 |

| 91 days to 120 days | 4.25 | 4.25 | 4.75 | 4.75 |

| 121 days to 180 days | 4.50 | 4.53 | 5.00 | 5.03 |

| 181 days to 210 days | 5.25 | 5.28 | 5.75 | 5.79 |

| 211 days to 269 days | 5.50 | 5.58 | 6.00 | 6.09 |

| 270 days or below 1 year | 5.75 | 5.83 | 6.25 | 6.35 |

| 1 Year to 1 Year 2 Days | 6.50 | 6.61 | 7.00 | 7.12 |

| 1 Year 3 Days to 1 Year 2 Months | 6.50 | 6.66 | 7.00 | 7.19 |

| Above 1 Year 2 Months to below 1 Year 6 Months | 6.50 | 6.71 | 7.00 | 7.25 |

| 1 Year 6 Months to below 1 Year 7 Months | 6.50 | 6.77 | 7.00 | 7.31 |

| 1 Year 7 Months to below 2 Years | 6.50 | 6.77 | 7.00 | 7.31 |

| 2 years to below 2 years 6 Months | 6.50 | 6.88 | 7.00 | 7.44 |

| 2 years 6 Months to below 2 years 9 Months | 6.50 | 7.05 | 7.00 | 7.65 |

| 2 years 9 Months to below 3 years | 6.50 | 7.11 | 7.00 | 7.71 |

| 3 years to below 61 month | 6.50 | 7.36 | 7.00 | 8.00 |

| 61 month and above | 6.25 | 7.27 | 6.75 | 7.95 |

| Indus Tax Saver Scheme (5 years) | 6.50 | 7.61 | 7.00 | 8.30 |

*Interest is compounded quarterly. Annualized yield is effective annual return basis the same.

# Simple interest will be paid on maturity for deposit wherever the tenure is upto 180 days.

| Please Note |

| **Penal interest rate charge of 1% would apply on premature withdrawal. ***Premature withdrawal is not allowed on Non-Callable FDs (FDs where Premature Withdrawal is Not Allowed) for value greater than equal to 1 cr. Non-Callable FDs are allowed only for Non-Individuals. # Simple interest will be paid on maturity for deposit wherever the tenure is upto 180 days. Income more than tax exempted limits earned through interest on FD is tax deductible. In the absence of PAN card, TDS will be deducted at 20%. NRE deposit rates are applicable only for Tenure 1 year 1 day onwards. |

| Senior Citizens - Additional interest rate on Domestic Term Deposits |

| *An additional interest rate of 0.50% over and above the card rates is applicable for Term Deposits of Senior citizens (Age 60 years & above) for value below Rs. 2 cr. (Not applicable for NRO/NRE deposits). However, in case the senior citizen opts to place deposits of value greater than or equal to 2 Cr, the benefit of additional interest shall not be available. |

FD Rates w.e.f. December 30th, 2020

| Maturity Period | 2 crore to less than 5 crores- Premature Withdrawal Allowed** | 1 crore to less than 5 crores- Premature Withdrawal Not Allowed*** | ||

| (Only for Non-Individuals) | ||||

| Rate | Annualised Yield* | Rate | Annualised Yield* | |

| 7 days to 14 days | 3.00 | 3.00 | 3.00 | 3.00 |

| 15 days to 30 days | 3.00 | 3.00 | 3.00 | 3.00 |

| 31 days to 45 days | 3.25 | 3.25 | 3.25 | 3.25 |

| 46 days to 60 days | 3.50 | 3.50 | 3.60 | 3.60 |

| 61 days to 90 days | 3.75 | 3.75 | 3.85 | 3.85 |

| 91 days to 120 days | 4.00 | 4.00 | 4.10 | 4.10 |

| 121 days to 180 days | 4.25 | 4.25 | 4.35 | 4.35 |

| 181 days to 210 days | 5.00 | 5.03 | 5.10 | 5.13 |

| 211 days to 269 days | 5.25 | 5.32 | 5.35 | 5.42 |

| 270 days or below 1 year | 5.60 | 5.68 | 5.75 | 5.83 |

| 1 Year to 1 Year 2 Days | 6.25 | 6.35 | 6.35 | 6.45 |

| 1 Year 3 Days to 1 Year 2 Months | 6.25 | 6.40 | 6.35 | 6.50 |

| Above 1 Year 2 Months to below 1 Year 6 Months | 6.40 | 6.61 | 6.50 | 6.71 |

| 1 Year 6 Months to below 1 Year 7 Months | 6.40 | 6.66 | 6.50 | 6.77 |

| 1 Year 7 Months to below 2 Years | 6.40 | 6.66 | 6.50 | 6.77 |

| 2 years to below 2 years 6 Months | 6.40 | 6.77 | 6.50 | 6.88 |

| 2 years 6 Months to below 2 years 9 Months | 6.40 | 6.94 | 6.50 | 7.05 |

| 2 years 9 Months to below 3 years | 6.40 | 6.99 | 6.50 | 7.11 |

| 3 years to below 61 month | 6.40 | 7.23 | 6.50 | 7.36 |

| 61 month and above | 6.15 | 7.14 | 6.25 | 7.27 |

| Indus Tax Saver Scheme (5 years) | NA | NA | NA | NA |

FCNR / RFC* Deposits - w.e.f. December 1st, 2020

| Period | USD | GBP | EUR | JPY | CAD | AUD |

| 1yr < 2 yrs | 2.22 | 1.85 | 1.48 | 0.02 | 2.62 | 2.00 |

| 2 yrs< 3 yrs | 2.26 | 2.00 | 1.48 | 0.01 | 2.50 | 2.08 |

| 3 yrs< 4yrs | 2.00 | 1.55 | 1.30 | 2.95 | 2.45 | 2.30 |

| 4 yrs< 5 yrs | 1.75 | 1.55 | 1.15 | 0.01 | 2.45 | 2.35 |

| 5 yrs | 1.70 | 1.70 | 1.10 | 2.96 | 2.30 | 2.30 |

|

| In case of pre-mature withdrawal of FCNR (B) deposits, |

|

| In case of premature closure of NRE / FCNR/ RFC Term deposit the interest rate payable will as under: |

|

| Method of calculation of interest: |

|

| Interest on Fixed Deposit can be paid for a period of less than a quarter (monthly interest payout) at the discounted interest rates as per regulatory directives. |

Recurring Deposits Rates w.e.f. December 30th, 2020

Indusind Bank Nre Savings Account Interest Rates

Indusind Bank Savings Account Interest Rate Comparison

Indusind Bank Fd Interest Rate

| Tenure | Interest Rate p.a.(%) | Senior Citizen Rates p.a.(%) |

| 09 Months | 5.75 | 6.25 |

| 12 Months | 6.50 | 7.00 |

| 15 Months | 6.50 | 7.00 |

| 18 Months | 6.50 | 7.00 |

| 21 Months | 6.50 | 7.00 |

| 24 Months | 6.50 | 7.00 |

| 27 Months | 6.50 | 7.00 |

| 30 Months | 6.50 | 7.00 |

| 33 Months | 6.50 | 7.00 |

| 3 years to below 61 month | 6.50 | 7.00 |

| 61 month and above | 6.25 | 6.75 |

|